Tax Treatment of Gifts in Germany

1. Introduction

The tax treatment of gifts poses challenges for many companies. Especially the various exemption limits and documentation requirements often cause uncertainty. This article gives you a clear overview of the most important regulations and shows how you can simplify the process with Presentolo's gift link platform.

2. Legal Foundations

The tax treatment of gifts is primarily determined by the following regulations:

- § 4 Abs. 5 Nr. 1 EStG: Establishes the tax treatment of gifts as business expenses. Since 01.01.2024, an exemption limit of 50 euros per year for business partners applies.

- § 37b EStG: Allows the gifting company to take over the tax with a flat tax rate of 30% (plus solidarity surcharge and possibly church tax).

- § 8 Abs. 1 EStG: Regulates the tax distinction between benefits in kind and cash wages for employee gifts.

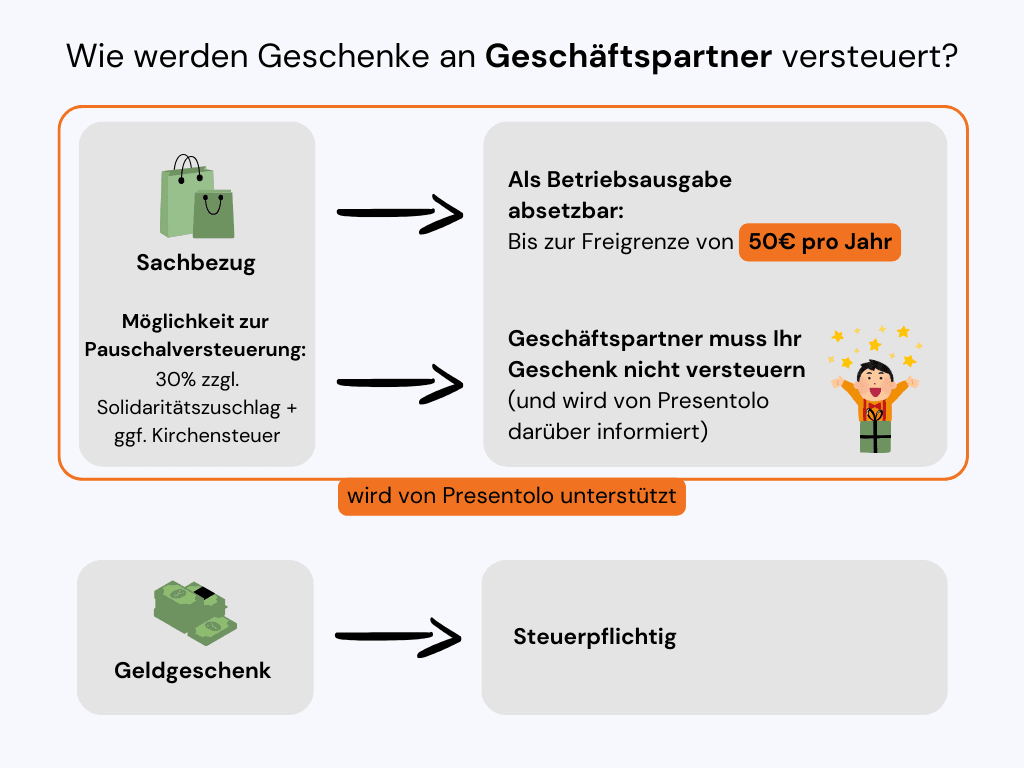

3. Gifts to Customers & Business Partners

The 50-Euro Limit

For gifts to business partners, an annual exemption limit of 50 euros per recipient applies [§ 4 Abs. 5 Nr. 1 EStG]. Gifts to business partners up to this limit can always be deducted as business expenses. Whether VAT must be included in this exemption limit depends on whether the gifting company is entitled to input tax deduction. If yes, then the net value of goods applies, otherwise VAT must be added. The following should also be noted:

- The limit applies per recipient and fiscal year

- This is an exemption limit, not an allowance - if exceeded, the entire amount is not deductible as a business expense

Flat-rate taxation according to § 37b EStG

If the gifted business partner is an entrepreneur, the value of the gift must usually be taxed as business income. To prevent the recipient from having to tax the gift, the giving company can take over the tax at a flat rate. This is done through flat-rate taxation of 30% plus solidarity surcharge [§ 1 Abs. 1 Nr. 3 SolZG] and possibly church tax [Anhang 21b LStH 2023]. The assessment basis for the flat-rate tax is the gross expenses [§ 37b Abs. 1 EStG].

Important

The decision for flat-rate taxation must be made uniformly for all gifts within the respective group (customers/business partners or employees) of a fiscal year. Flat-rate taxation for only individual gifts is not permitted [BMF letter dated 19.05.2015, subject: Flat-rate taxation of income tax for gifts according to § 37b EStG].

So whoever taxes a customer gift at a flat rate must do this for all customer gifts within a fiscal year (same applies to employee gifts that exceed the respective 50 or 60 euro limits - see following chapter).

4. Gifts to Employees

Benefits in Kind and Tokens of Appreciation: Important Distinction

Allowances to employees can always be deducted as business expenses without limit. However, in the tax treatment of these allowances as wages, the distinction between regular benefits in kind and tokens of appreciation for special occasions is important:

1. Tokens of appreciation for special occasions (60€ limit)

Gifts for personal occasions (such as birthday, wedding, birth of a child, anniversary, etc.) up to a value of 60€ (incl. VAT) per occasion [R 19.6 Wage Tax Guidelines 2015]:

- It must be a pure benefit in kind

- Within the 60€ limit, these gifts do not count as wages and are therefore tax-free

- If the 60€ limit is exceeded, the entire amount becomes taxable wages

- Multiple gifts for different personal occasions are possible

- Tip: Tip: Presentolo gift links also count as benefits in kind

2. Monthly benefits in kind (50€ limit)

Additionally, employees can receive monthly benefits in kind:

- Monthly exemption limit of 50€ for benefits in kind [§ 8 Abs. 2 Satz 11 EStG]

- Must be granted in addition to regular salary [§ 8 Abs. 2 Satz 11 EStG]

- Vouchers must be limited to specific goods or services [§ 8 Abs. 2 Satz 11 EStG and § 2 Abs. 1 Nr. 10 ZAG]

- There must be no cash payment

- Tip: Tip: Presentolo gift links can also be used here

Important Note on Taxation

If the respective limits are exceeded:

- The entire amount must be taxed as wages

- Social insurance contributions are due

- Your company can take over the flat-rate taxation in this case (as with customer gifts)

Practical Tip: Generation of Receipts with Presentolo

When generating a gift link via Presentolo, you can directly select the recipient type (employee/business partner) and the occasion. The system creates the receipts you need for tax returns to handle your gifts optimally for tax purposes.

5. Practical Implementation with Presentolo

Presentolo Gift Links Overview

You can choose from three gift link categories:

Standard

20€

incl. VAT

For Employees

- ✓Small tokens of appreciation for personal occasions (60€ limit)

- ✓Monthly benefits in kind (50€ limit)

For Business Partners

- ✓Small gifts e.g. for compensation (50€ annual limit with possible flat tax)

Premium

50€

incl. VAT

For Employees

- ✓Tokens of appreciation for special occasions (60€ limit)

- ✓Monthly benefits in kind (50€ limit)

For Business Partners

- ✓E.g. annual gifts for holidays or other occasions (50€ limit with possible flat tax)

Exclusive

100€

incl. VAT

For Employees

- ✓Special occasions (with possible flat tax)

- ✓Exceptional achievements (with possible flat tax)

For Business Partners

- ✓Important milestones (with possible flat tax)

- ✓Long-term business relationships (with possible flat tax)

Important

Before giving your employees Presentolo gift links as monthly benefits in kind, you should check whether your company already distributes other gifts to avoid exceeding the monthly 50€ limit.

Specific Assignment of Gifts

When generating a gift link, the following are recorded:

- Recipient type (employee/business partner)

- Occasion of the gift

- Value and category of the gift

- Time of generation

- Name of the recipient

Creation of Receipts

Our Presentolo platform offers:

- Creation of necessary receipts for accounting

- Setting annual tax policies for flat-rate taxation of gifts

- Informing gift recipients about the flat-rate taxation performed (or not performed) by your company

Practical Tip: Annual Planning

Use Presentolo's reporting function for optimal gift strategy. The dashboard shows the current status of all gifts and helps comply with various exemption limits. Note the different rules:

- Customers & business partners: max. 50€ per year per recipient

- Employee benefits in kind: max. 50€ per month per recipient

- Employee tokens of appreciation: max. 60€ per occasion

6. Conclusion

The tax treatment of gifts requires careful planning and documentation. With a digital system like Presentolo, you can:

- Save time and effort in administration

- Give gifts efficiently and legally compliant

- Keep track of all created gifts

- Create the documentation necessary for tax treatment

As of: January 2025. This article serves general information purposes and does not replace individual tax advice.